Perspective | Practical Guide on Legal Boundaries of Securities Misrepresentation and Methods for Calculating Damages

Published:

2025-09-30

As the cornerstone of credit in capital markets, the quality of information disclosure directly determines the effectiveness of investor decision-making and the efficiency of resource allocation. According to the 2025 "White Paper on Securities Dispute Adjudication" released by the Beijing Financial Court, disputes arising from false statements account for 99.7% of all securities fraud cases, with financial fraud accounting for more than one-third of these incidents. From Kangmei Pharmaceutical’s massive 10-billion-yuan fund manipulation to Meishang Ecology’s eight consecutive years of artificially inflated profits, such misconduct not only erodes market trust but also undermines the institutional foundation of the "three publics" principle—fairness, openness, and justice. Although the 2022 "New Judicial Interpretation" has introduced more refined criteria and loss calculation rules since its implementation, ambiguities remain regarding the boundaries of constituent elements, as well as challenges in quantifying systemic risks. This article examines typical cases from 2024–2025, dissecting the logic behind identifying false statements and the methods used to calculate related losses. It also highlights the crucial role lawyers play in guiding practical applications, offering comprehensive guidance to market participants.

Speech

Information disclosure, as the cornerstone of credit in capital markets, directly determines the effectiveness of investor decision-making and the efficiency of resource allocation. According to the 2025 "White Paper on Securities Dispute Adjudication" released by the Beijing Financial Court, disputes arising from false statements account for 99.7% of all securities fraud cases, with financial fraud accounting for more than one-third of these incidents. From Kangmei Pharmaceutical’s massive 10-billion-yuan fund manipulation to Meishang Ecology’s eight consecutive years of artificially inflated profits, such misconduct not only erodes market trust but also undermines the institutional foundation of the "three publics" principle—fairness, openness, and impartiality. Since the implementation of the 2022 "New Judicial Interpretation," the criteria for determining liability and the rules for calculating damages have been further refined. However, ambiguities remain regarding the boundaries of key elements, and challenges persist in quantifying systemic risks. This article examines typical cases from 2024–2025, dissecting the logic behind identifying false statements and the methodologies used to calculate losses. It also highlights the crucial role lawyers play in guiding practical applications, offering comprehensive guidance to market participants.

I. The Statutory Definition of False Statements in Securities

(1) Core Constitutive Elements

According to the 2022 "New Judicial Interpretation," a false statement must meet two key requirements—“violation of disclosure obligations + statutory defects in the information”—and is specifically categorized into three scenarios:

1. False Recordings: Actively fabricating inaccurate information

The essence of the law: Actively creating false facts through fictitious transactions, falsified documents, and other deliberate actions—its core characteristic being the audacious "creation out of nothing," thereby undermining the fundamental principle of truthful information disclosure.

Typical Case: Meishang Ecology Financial Fraud Case

In 2023, the China Securities Regulatory Commission (CSRC) found that Meishang Ecology had artificially inflated its net profits for eight consecutive years—from 2012 through the first half of 2020—by means such as fabricating engineering settlement documents and forging payment receipts. This resulted in false statements in its prospectus and periodic reports, and also led to fraudulent issuance during its non-public stock offering in 2018. In 2024, the Shenzhen Intermediate Court initiated a special representative lawsuit, naming securities firms involved as co-defendants for failing to exercise due diligence. The case highlights a new trend: the "long-term and chain-like" nature of these fraudulent practices.

Typical Case: Zijing Storage Fraudulent Issuance Case

As the first case of delisting due to fraudulent issuance on the STAR Market, the company fraudulently obtained its listing qualification by forging sales contracts and artificially inflating revenue. The court determined that the financial data disclosed in its prospectus constituted a classic case of false representation, and the intermediary institutions were held jointly liable for failing to conduct thorough due diligence.

2. Misleading statement : One-sided disclosure triggers cognitive bias

The essence of the law lies in manipulating information—specifically, selectively disclosing or using ambiguous language to create a misleading impression due to incomplete details. At its core is the art of "half-truths."

Typical Case: Jintongling Information Disclosure Case

In 2024, an investigation by the Jiangsu Securities Regulatory Bureau revealed that Jintongling manipulated its profits from 2017 to 2022 by methods such as recognizing revenue across fiscal periods and fabricating related-party transactions. The company disclosed only consolidated revenue figures in its annual reports while deliberately concealing the details of its subsidiaries' fraudulent performance, misleading investors into misjudging the profitability of its core business operations. The court noted that this practice of "selectively disclosing key data" is a classic example of misleading statements.

Practical characteristics: According to the Shanghai Financial Court's 2025 report, misleading statements often take the form of "concealing performance-dependent assumptions" or "vague risk warnings," such as disclosing only the order amount without mentioning that the fulfillment rate is below 30%.

3. Major Omission : Key information that should have been disclosed but wasn't

The essence of the law: Failure to disclose material matters as required by law stems fundamentally from "passive inaction," creating information gaps—commonly seen in areas such as related-party transactions and debt risks.

Typical Case: A Private Bond Default Case

In 2024, a private bond issuer failed to disclose three lawsuits in its offering document—each involving amounts exceeding 40% of the company’s net assets. After the bonds defaulted, the court determined that this omission not only constituted a material oversight (by failing to disclose the litigation matters) but also misled investors due to misleading statements regarding the issuer’s financial stability. Ultimately, the court held the issuer accountable under the "material omission" charge, marking a significant departure from the customary practice of exempting private bonds from full disclosure requirements.

Typical Case: A Technology Company's Related-Party Transaction Case

The company had cumulative non-operational fund transactions totaling 6.2 billion yuan with its controlling shareholder from 2019 to 2023, yet failed to disclose the purposes of these funds or the associated risks of fund occupation as required. In 2025, investors pursued recovery through a special representative lawsuit, and the court adopted a dual criterion—based on both the scale of fund occupation and the duration of undisclosed usage—to determine the materiality of the omission.

4. Definition, Distinction, and Relationship Among the Three Essential Elements

Combining judicial practice, the boundaries among the three can be distinguished through a three-dimensional framework of "behavioral patterns – information characteristics – responsibility gradient."

5. Rules for Handling Cross-Competitive Collaboration

In practice, the phenomenon of intertwined multiple types of behavior is particularly prominent. The Beijing Financial Court has established the principle of "prioritizing core actions."

(1) When false statements overlap with other types of misconduct, the false statement takes precedence in determination. For instance, in the case of Meishang Ecology, where there was both an overstatement of profits (a false statement) and failure to disclose related-party transactions (a material omission), the court used the false statement as the basis for holding liability.

(2) When misleading statements and material omissions overlap, distinguish based on the "intention behind information manipulation." If the intent is to mislead, classify it as a misleading statement—for example, disclosing only an earnings forecast without revealing that the probability of achieving it is less than 10%. However, if the omission itself is simply due to failure to disclose relevant information, classify it as a material omission.

(3) In terms of liability, the compensation ratio for false statements is typically 15%–30% higher than that for material omissions, reflecting differences in subjective fault.

(II) Definition of Special Circumstances

1. Responsibility Boundaries of Intermediary Institutions:

In the Meishang Ecology case, GF Securities was ordered to forfeit its underwriting income and pay a fine for failing to verify the authenticity of the project settlement documents. The court clarified that determining whether an intermediary agency has "failed to exercise due diligence" must be based on the "standard of professional duty of care," and emphasized that underwriters' verification of financial data should reach the level of "penetrative scrutiny."

2. Responsibility for Predictive Disclosure:

The Shanghai Financial Court clarified that reasonable forecasts must meet the dual conditions of "having reliable grounds + providing adequate risk warnings." For instance, if a company predicts an "annual growth rate of 50%" but fails to disclose that its core technology has not yet entered mass production, such a statement would constitute misleading information.

II. The Core Framework and Method for Loss Calculation

(1) The Statutory Boundaries of Compensation Scope

According to the "New Judicial Interpretation," the scope of losses is limited to the difference in investment value, along with associated commissions and stamp taxes; interest losses, however, are not covered. In the 2024 Zeda Yisheng case, the court-approved compensation of 280 million yuan was broken down as follows: 92% accounted for the investment loss, while transaction taxes and fees made up the remaining 8%, accurately reflecting this principle.

(II) Calculation of Damages from Bullish False Statements

Accounting for more than 90% of false representation cases, the core issue revolves around calculating the "price difference loss from high-price purchases."

1. Reveal future sales details

Loss = (Weighted Average Purchase Price - Weighted Average Selling Price) × Number of Shares Sold

Case Study: Calculation of Losses for Jintongling Investors

A certain investor purchased 20,000 shares at an average price of 12 yuan each in 2020 (after the implementation date), and then sold them at 7.5 yuan each on the disclosure date in 2024 (the day the China Securities Regulatory Commission announced the initiation of an investigation). Using the "first-in, first-out" method to calculate the average purchase price, the loss amounted to (12 - 7.5) × 20,000 = 90,000 yuan.

2. Situations Where No Sales Were Made Before the Base Date

Loss = (Weighted Average Purchase Price - Benchmark Price) × Number of Shares Held

Example of benchmark price determination:

The company's disclosure date was June 1, 2024, after which the cumulative turnover rate reached 100% over the subsequent 25 trading days. The benchmark price was calculated as the average closing price within that period, at 6.8 yuan. A certain investor held 10,000 shares (bought at an average price of 11 yuan), resulting in a loss of (11 - 6.8) × 10,000 = 42,000 yuan.

(III) Calculation of Damages from Bullish-Induced False Statements

Although it accounts for less than 10%, the judicial rules have been clearly defined, with the core being the "loss from the price difference when selling at a low price."

Typical Case: The Case of a Certain Pharmaceutical Company

In 2023, the company concealed its cooperation agreement with a multinational pharmaceutical company (a positive development), causing the stock price to drop to 8 yuan, prompting investors to sell off 10,000 shares. By 2024, after the announcement was made, the stock price rebounded to 15 yuan, leading investors to buy back their shares at an average cost of 14 yuan each. The court calculated the investor losses as (14 - 8) × 10,000 = 60,000 yuan, with the benchmark price determined based on the average trading price over the 10 trading days following the announcement.

(IV) Rules for Determining the Base Date and Base Price

1. Benchmark Date Determination :

Following the principle of "prioritizing compliance with the turnover rate threshold," for cases where the turnover rate reaches 100% within 10 trading days from the disclosure date, the 10th day will be used as the benchmark date; if the threshold isn't met, the deadline is extended to the 30th day. In a 2024 case involving a STAR Market company, the court set the 30th day after disclosure as the benchmark date because the stock price experienced consecutive daily limit-downs, resulting in an insufficient turnover rate.

2. Benchmark Price Calculation:

Under extreme market conditions, the "exclusion of abnormal fluctuations" method is employed: for instance, if a certain ST-listed company experiences three daily limit-ups within its benchmark range, the court will exclude the prices recorded on those limit-up days when calculating the weighted average price, thereby preventing overvaluation and potential losses.

III. Practical Challenges and Pathways for Dispute Resolution

(1) Quantitative Methods for Systemic Risk Deduction

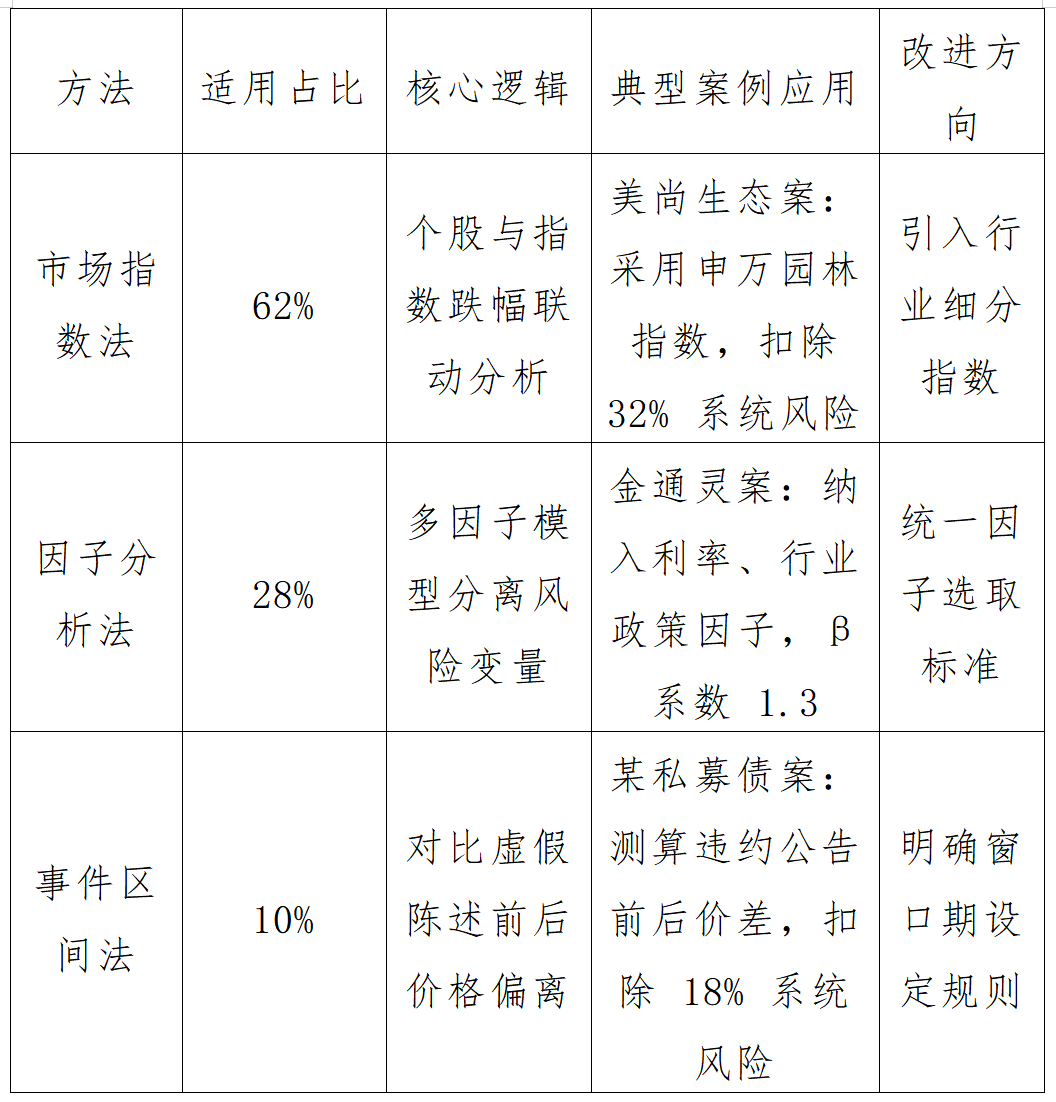

In judicial practice, three mainstream approaches have emerged. According to the 2025 Shanghai Financial Court report, their respective application rates are as follows:

(II) Special Handling of False Statements in Bonds

Referencing the 2020 Bond Dispute Minutes, loss calculations must take into account redemption status:

Case: A Corporate Bond Default Case

Institutional investors purchased 5,000 bonds at 100 yuan per bond and later sold them at 45 yuan each, realizing a payout of 15 yuan per bond. As a result, their total loss amounted to (100 - 45 - 15) × 5,000 = 200,000 yuan. However, the court used the China Central Depository & Clearing Co. Corporate Bond Index for calculation and, after deducting 20% for systemic risk, determined the actual compensation to be 160,000 yuan.

Special rule: Private placement bonds must demonstrate that "the information significantly affects pricing," while publicly offered bonds are automatically presumed to have such an impact.

(III) Judicial Determination of Key Dates

1. Date of Disclosure: According to the "First Official Disclosure Day," the 2024 re-trial case of LeEco Network clearly established that the date when the China Securities Regulatory Commission (CSRC) issued its investigation announcement takes precedence over the date of media exposure—owing to the former’s credibility and its more direct impact on the market.

2. Implementation Date: Distinguish between proactive disclosure and passive disclosure. For instances of intentional misrepresentation, the implementation date will be the announcement date; for cases involving concealment, the implementation date will be "the day when disclosure was required." For example, if a related-party transaction occurs but remains undisclosed for two trading days, the next trading day will be designated as the implementation date.

IV. Compliance Tips and Rights Protection Recommendations

1. Claim Eligibility Determination:

It must meet the criteria of "purchase after implementation date + holding prior to disclosure date." In a case from 2025, an investor bought the stock one month before the implementation date; although the investor sold the shares after the disclosure date, the lawsuit was still dismissed.

2. Key points for evidence preparation:

(1) Transaction records must include a consolidated statement for multiple accounts, stamped with the official seal of the brokerage firm.

(2) Evidence of false statements must be marked with the announcement reference number and disclosure time;

(3) Loss estimation must be conducted using the court-approved "weighted average method," and may be entrusted to China Securities Investor Service Center Issue the report.

3. Accountability Techniques for Intermediary Institutions:

For securities firms, it may be argued that they "failed to fulfill their ongoing supervisory obligations." For instance, in the Jintongling case, investors successfully added Huaxi Securities as a defendant after providing evidence that the firm had failed to verify financial irregularities at its subsidiary. Meanwhile, for auditing institutions, a key focus should be on thoroughly examining "deficiencies in the confirmation procedures."

4. The Core Guiding Role of Lawyers in the Practical Application of Securities Misrepresentation Cases

(1) Investor Side: End-to-End Rights Protection Support

(2) Issuer and Intermediary Entities: Compliance and Risk Management

(3) End-to-End Dispute Resolution Support

For contentious issues in false representation cases, such as "determination of the benchmark date" and "methods for calculating losses," lawyers can prepare legal opinion letters, citing previous precedents from the Beijing/Shanghai Financial Courts to provide reference for court judgments. During the mediation phase, lawyers can also draw on compensation ratios from similar cases to help parties craft a reasonable settlement proposal. For instance, in a certain private equity bond case, the lawyer referenced the settlement ratio achieved in the Wuyang Bond case, successfully facilitating an agreement between investors and the issuer for 85% compensation of their claimed losses.

1. Initial Qualification Screening and Risk Assessment: Drawing from cases such as Meishang Ecology and Jintongling, lawyers can swiftly determine whether investors are eligible for claims by comparing the "Implementation Date - Disclosure Date" period and analyzing transaction records, thus avoiding unnecessary litigation. For instance, in a certain private bond case, lawyers reviewed the disclosure milestones outlined in the offering documents and found that 37% of investors were excluded from claiming damages because their purchase dates fell before the implementation date.

2. Evidence Compliance Organization: For challenging scenarios such as multi-account trading and fragmented announcements, lawyers can guide investors in retrieving complete transaction records and systematically organizing them. Additionally, they can help annotate false disclosure announcements with the three essential elements—“Document Number + Disclosure Platform + Content Summary”—to ensure that the evidence meets the court’s requirements for presenting proof. For instance, in the Zeda Yisheng case, lawyers assisted investors in consolidating transaction records from 12 separate accounts and used Excel formulas to automatically calculate the weighted average price, significantly enhancing the efficiency of loss assessment.

3. Litigation Strategy Development: Lawyers can choose either a "Special Representative Litigation" or "Individual Litigation" based on the scale of the case. To address disputes over systemic risk deductions, they should proactively prepare defense materials such as industry index comparison charts and detailed explanations of policy impacts. For instance, in the Meishang Ecology case, the lawyer cited Shenwan Landscape Index Simultaneous decline data successfully reduced the system risk deduction ratio from 40% to 32%.

4. Information Disclosure Compliance Review: Lawyers can conduct a dual-check on documents such as annual reports and offering prospectuses, verifying both their "authenticity" and "completeness." For forward-looking information—such as performance forecasts—they assist in supplementing it with "basis for realization + risk warnings," thereby preventing misleading statements. For instance, prior to an IPO, lawyers at a technology company discovered that the company had failed to disclose a key patent lawsuit; after promptly adding this critical disclosure, they successfully mitigated potential listing risks.

5. Regulatory Investigation Response: When faced with an investigation initiated by the China Securities Regulatory Commission, lawyers can guide issuers in organizing transaction documents and preparing statements and rebuttals, clearly highlighting key defense points such as "no subjective fault." For instance, in a case involving related-party transactions of a certain company, the lawyer successfully demonstrated that the fund transfers were "temporary loans that have since been repaid," thereby helping to mitigate the severity of the penalty imposed.

6. Establishing Internal Control Mechanisms: Lawyers can assist issuers in setting up an "Information Disclosure Review Process," clearly defining the responsibilities of directors, supervisors, senior management, the finance department, and the legal department. They can also conduct regular information disclosure training sessions to reduce the likelihood of false statements.

Closing remarks

The regulation and response to securities misrepresentations are not only central issues in maintaining the integrity of the capital market but also critical for various market participants to effectively manage risks and protect their rights and interests. This article systematically examines the defining criteria and loss calculation methods under the framework of the 2022 "New Judicial Interpretation," while drawing on recent high-profile cases such as Meishang Ecology and Jintongling. It clearly outlines the end-to-end logic behind misrepresentation—from "qualitative assessment" to "quantitative measurement"—highlighting in particular the indispensable role lawyers play in stages like eligibility screening, evidence organization, and strategy development. For investors, lawyers serve as the "navigation system" guiding them through the维权 process; for issuers and intermediary institutions, lawyers act as the "firewall" ensuring compliance and risk mitigation.

As the registration-based reform deepens and regulatory oversight strengthens, the criteria for identifying false statements will become increasingly refined, while the quantitative methods for calculating losses will continue to evolve and improve. Moving forward, whether investors aim to enhance their ability to protect their rights, issuers strive to solidify compliance standards, or intermediary institutions fulfill their "gatekeeper" responsibilities, all must rely on legal frameworks and draw from practical case studies—guided by expertise—to strike a balanced approach between rights and responsibilities. If further exploration of specific details regarding certain types of false statements, or tailored solutions for rights protection or compliance is needed, in-depth, specialized analyses can be conducted based on real-world cases.

Key words:

Previous article

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province