Perspective | The Effectiveness and Liability Determination Rules for Unauthorized Guarantees Under the Judicial Interpretation of the Security System in the Civil Code

Published:

2025-09-29

In daily corporate operations and financing activities, it is all too common for the legal representative to unilaterally provide external guarantees in the company's name without going through the company's internal resolution process—this is what we often refer to as "ultra vires guarantee." Prior to the enactment of the Civil Code and its accompanying judicial interpretation on the guarantee system, there was significant controversy in judicial practice regarding the validity of contracts involving ultra vires guarantees and the allocation of liability, creating considerable challenges for lawyers and businesses in managing legal risks.

Preface

In daily corporate operations and financing activities, it is not uncommon for the legal representative to unilaterally provide external guarantees in the company's name without going through the company's internal decision-making procedures—this is what we commonly refer to as "ultra vires guarantee." Prior to the enactment of the Civil Code and its judicial interpretation on the guarantee system, there was significant controversy in judicial practice regarding the validity of contracts involving ultra vires guarantees and the allocation of liability, posing considerable challenges for lawyers and companies in managing legal risks.

Article 61 and Article 504 of the Civil Code, along with Articles 7 through 11 of the "Interpretation by the Supreme People's Court on the Application of the Security System Provisions of the Civil Code of the People's Republic of China" (hereinafter referred to as the "Judicial Interpretation on the Security System"), collectively establish a new, logically coherent framework for rules governing unauthorized guarantees. This article will, in conjunction with these relevant provisions, outline the core principles and practical strategies for entrepreneurs and colleagues to effectively address such issues in their daily operations.

I. A Shift in Core Philosophy: From "Internal Restrictions" to "Representational Authority Restrictions"

Traditional views often equate the company's articles of incorporation with Article 15 of the Company Law The provisions regarding guarantee resolutions are regarded as "internal limitations" on the authority of the legal representative, implying that they do not automatically bind bona fide counterparties. Meanwhile, the core shift in the rules outlined in the "Judicial Interpretation on the Guarantee System" lies in elevating the requirement for a corporate resolution to a statutory prerequisite for determining whether the legal representative enjoys the legal power to act as an agent for external guarantees.

Simply put, according to Article 61, Paragraph 3 of the Civil Code—stating that "Restrictions on the representative authority of a legal representative as stipulated in the articles of association or by the legal entity's governing body shall not be enforceable against bona fide third parties"—and further clarified by the Judicial Interpretation on the Security System, a corporate resolution serves as the "pass" that grants the legal representative valid authority to act on behalf of the company. Therefore, when accepting a guarantee, the counterparty has a duty of reasonable care to examine this "pass."

II. The "Three-Step Review Method" for Determining Validity: Whether the other party acted in "good faith" is the key.

According to the regulations, the validity of contracts involving unauthorized guarantees is no longer a one-size-fits-all situation—it now depends on whether the creditor (the other party) acted in "good faith" when entering into the guarantee contract. We can make this determination using the following "three-step method":

Step 1: Distinguish between types of guarantees and determine whether a resolution is required.

Not all guarantees require a corporate resolution. Article 8 of the "Judicial Interpretation on the Guarantee System" outlines four exceptional scenarios in which a guarantee contract remains valid even without a resolution.

Financial institutions issue letters of guarantee, or guarantee companies provide guarantees;

The company provides a guarantee for the business operations of its wholly-owned subsidiary;

The guarantee contract must be signed and approved by shareholders holding more than two-thirds of the voting rights on the guarantee matters.

Listed companies provide guarantees, and the other party enters into the guarantee contract solely based on publicly disclosed information.

In addition to the scenarios mentioned above, providing a guarantee for others generally requires a resolution from the company's governing body (the board of directors or the shareholders' meeting/shareholders' general meeting).

Step 2: Review the resolution's content to determine whether it is "eligible."

The resolution that the counterparty needs to review must be a lawful and valid one, as stipulated in Article 15 of the Company Law. This includes:

Permissions are correct: Providing guarantees for the company's shareholders or actual controllers must be approved by a resolution of the shareholders' meeting, and associated shareholders must abstain from voting.

Program and Content Are Legal: The convening procedures, voting methods, and content of the resolution do not violate any laws, administrative regulations, or the company's articles of incorporation.

Step 3: Determining the "Reasonable Limit" of the Counterparty's Duty of Due Diligence

Article 7 of the "Judicial Interpretation on the Security System" clearly defines the counterparty's obligation for "formal review." This means the counterparty is not required to act like a detective by verifying the authenticity of the resolution or uncovering any underlying disputes—but they must ensure that:

Review the resolution document: Request the guarantor to provide the resolution documents within a reasonable timeframe.

Review surface compliance: Verify whether the signatures, voting percentages, and other surface-level information on the resolution comply with the provisions of the company's articles of association and corporate law.

As long as the other party has fulfilled the aforementioned formal review obligations, they can still be deemed "bona fide," even if the resolution is later proven to be forged or invalid.

III. New Rules for Liability Determination: Contract Invalidity Does Not Equal Total Absence of Liability

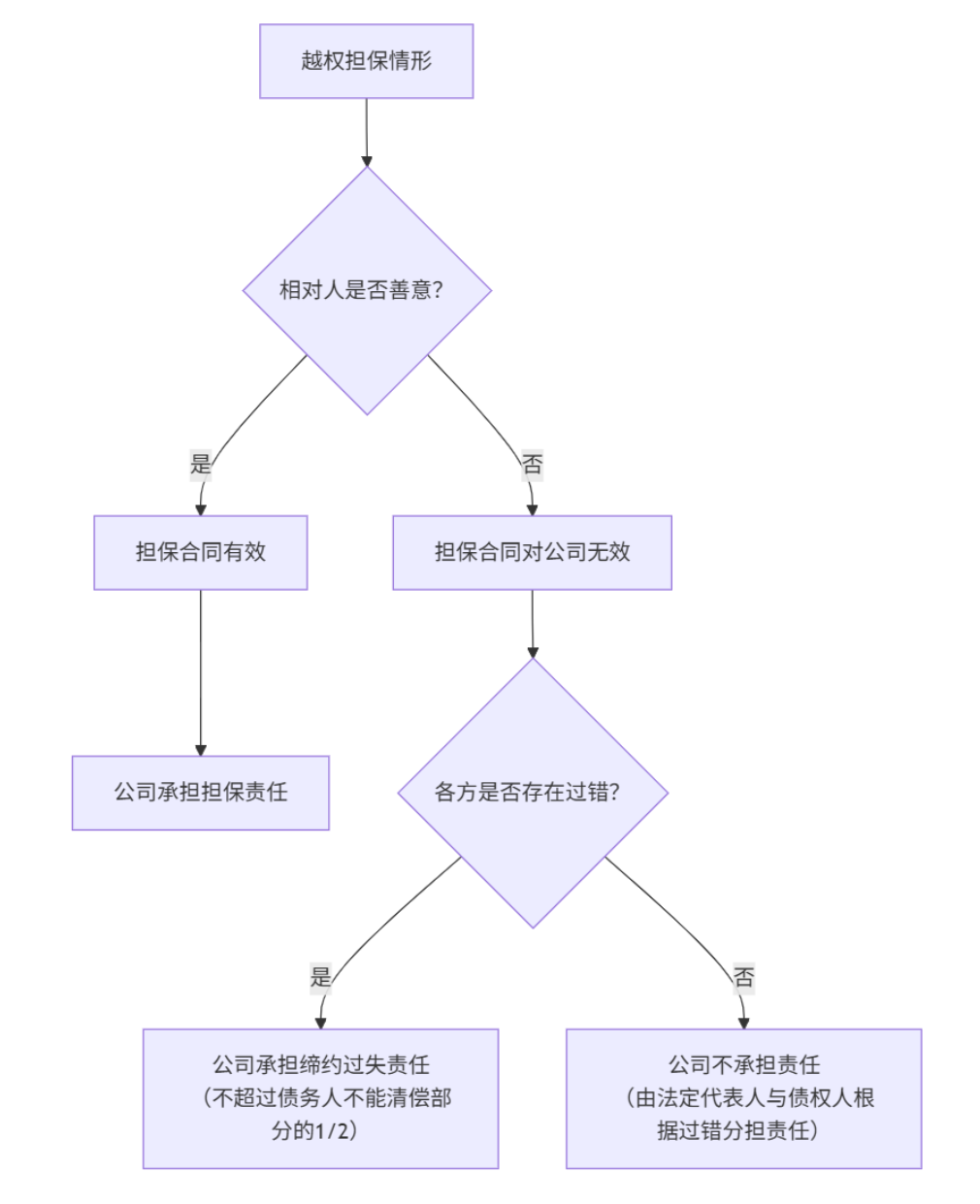

Depending on whether the counterparty acted in "good faith," the legal consequences of exceeding authority in providing a guarantee differ significantly. The following diagram clearly illustrates this determination process:

Scenario 1: The other party acts in good faith → The guarantee contract is valid, and the company assumes guarantee liability.

At this point, the legal representative's actions constitute apparent authority, rendering the guarantee contract valid. Consequently, the company must assume the guaranteed obligations as agreed. Subsequently, the company may seek reimbursement from the overstepping legal representative in accordance with its internal regulations.

Scenario 2: The other party acts in bad faith → The guarantee contract is invalid against the company, and the party at fault shares responsibility.

This is the most complex and critical scenario. After a contract is deemed invalid, liability is determined according to the "principle of fault-based responsibility":

The company's responsibilities: The creditor (the other party involved), fully aware that the legal representative acted beyond their authority, still proceeded to sign the contract—thus bearing primary fault themselves. However, if the company itself has been negligent in areas such as official seal management or personnel appointment, it will also be held liable for corresponding compensation. Article 17 of the "Judicial Interpretation on the Security System" clearly states that this type of compensation liability shall not exceed half of the portion that the debtor is unable to repay.

Responsibilities of the Legal Representative: Creditors may request the legal representative to fulfill the obligations stipulated in the guarantee contract or assume liability for compensation. This means that creditors can directly hold the legal representative accountable for signing beyond their authorized scope, significantly increasing the representative's personal risk.

IV. Legal Practice Recommendations

Based on the new rules outlined above, and to safeguard the interests of all parties, the following practical recommendations are proposed:

For creditors (financial institutions, enterprises, etc.):

"Resolution review" must become a standard risk control practice: When accepting any non-affiliated party's guarantee, reviewing the company's guarantee resolution must be a mandatory prerequisite procedure.

Create a standardized review checklist: The checklist should include elements such as the decision-making body, voting thresholds, recusal situations, and the completeness of signatures and seals, and must be reviewed by a professional legal expert or attorney, with review records properly archived.

Beware of " Radish Stamp "Risk: Although it is a formal review, resolutions that clearly raise doubts (such as inconsistent handwriting or obvious procedural flaws) should be further verified to avoid being labeled as "not acting in good faith."

For the guarantor (company):

Improve the internal control system: Strictly regulate the guarantee clauses in the company's articles of association, clearly defining the decision-making body for external guarantees, as well as the limits on amounts and the corresponding procedures.

Strengthening Official Seal and Personnel Management: Establish a strict approval system for the use of official seals and a system to inform legal representatives of their authorized powers, in order to prevent unauthorized actions by internal personnel.

Actively Asserting Rights: Once an unauthorized guarantee occurs, evidence should be actively gathered to prove that the creditor acted in bad faith, thereby avoiding liability under the guarantee.

For the legal representative:

Cultivate personal risk awareness: We must clearly recognize that overstepping one's authority in providing guarantees could expose individuals to significant risks of recovery, potentially even leading to the loss of their entire fortune.

Uphold the compliance bottom line: Strictly adhere to the company's decision-making procedures, and never sign guarantee documents externally without proper authorization or in cases where authorization is unclear.

Conclusion

The judicial interpretation of the Guarantee System under the Civil Code reshapes the rules on unauthorized guarantees, reflecting legislators' commitment to balancing the protection of transactional security with the interests of companies. It shifts the focus of risk prevention upstream, emphasizing the duty of due diligence that all parties involved must uphold. In this new legal landscape, creditors, companies, and even legal representatives alike must update their knowledge base and prioritize compliance reviews—only then can they effectively mitigate legal risks and ensure the safety of transactions.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province