Viewpoint... New Company Law Research: Prohibition of Corporate Financial Funding System Interpretation.

Published:

2024-06-19

This paper tries to interpret the company's financial support system from many aspects.

Introduction

The prohibition of corporate financial assistance system is a new provision of the new Company Law amendment, which is based on the institutional objectives of capital maintenance and is set up to prevent improper reduction of corporate property and the disguised distribution of corporate assets to future or former shareholders.

Before the promulgation of the new "Company Law", my country did not stipulate at the legal level whether companies can provide financial assistance for others to obtain their own shares. The clear provisions on prohibiting financial assistance are scattered in various regulatory documents, mainly concentrated in the China Securities Regulatory Commission., Shanghai and Shenzhen Stock Exchanges have relevant regulations on listed companies and unlisted public companies. The effectiveness of these provisions is low, which leads to great controversy in the judgment of the effectiveness of various financial assistance agreements in the past trial practice. Most courts have held that the relevant provisions on financial assistance are regulatory prohibitions or self-regulatory norms of the exchange and do not directly affect the judgment of the validity of the agreement. The revision of the new "Company Law", through the construction of the system of "principle prohibition-exception permission-legal liability", regulates the act of providing financial assistance to joint stock companies at the legal level for the first time, providing a clear basis for future judicial decisions. This paper tries to interpret the company's financial support system from the following aspects.

Directory

Overview of the 1. Prohibited Corporate Financial Assistance System

Meaning of financial support for (I) companies

The legal provisions of the (II) prohibiting the financial assistance system of companies.

The value orientation of the (III) prohibition financial aid system.

The System Construction and Interpretation of the New Company Law of 2. on the Company Financial Assistance System

The principle prohibition of the financial assistance system of (I) companies.

(II) Exceptions to Prohibiting Corporate Financial Assistance

Legal Liability of (III) Directors, Supervisors and Senior Managers

The relationship between the financial support system of 3. listed companies and Article 163 of the new Company Law

Overview of the 1. Prohibited Corporate Financial Assistance System

Meaning of financial support for (I) companies

Corporate financial assistance is the act of providing assistance to others in acquiring shares in a company or its holding company by way of gifts, loans, guarantees, indemnities, debt forgiveness and other means that result in a decrease in the company's net assets.

The legal provisions of the (II) prohibiting the financial assistance system of companies.

The value orientation of the (III) prohibition financial aid system.

1. Protection of corporate assets and shareholders' rights and interests:The legislative intent of the prohibition of the financial support system is to prevent the abuse of authority by the person in control of the company to use the assets of the company for the improper transfer of benefits for shareholders or potential shareholders to acquire shares in the company. This behavior may lead to the loss of the company's assets and harm the interests of other shareholders.

2. Safeguarding the interests of creditors:The prohibition of financial assistance rules is incorporated into the regulatory track of corporate distribution behavior because of its creditor protection function. This means that by prohibiting financial assistance, companies can avoid unfairly affecting the interests of creditors in recapitalization.

3. Promote the healthy development of the company:The provision of financial assistance must be based on the interests of the company and subject to the decision of the board of directors or shareholders' meeting. The prohibition of financial assistance helps the company to maintain a sound financial position, restricts controlling shareholders, actual controllers and directors from engaging in acts that harm the interests of the company or shareholders, ensures the transparency and fairness of the company's operations, and promotes the long-term and healthy development of the company.

4. Maintain market order:The prohibition of the financial assistance system helps to maintain order in the capital market and prevents companies from manipulating share prices or committing fraudulent acts of inflating capital through improper means. This is essential to maintain the fairness and efficiency of the capital market.

The System Construction and Interpretation of the New Company Law of 2. on the Company Financial Assistance System

The principle prohibition of the financial assistance system of (I) companies.

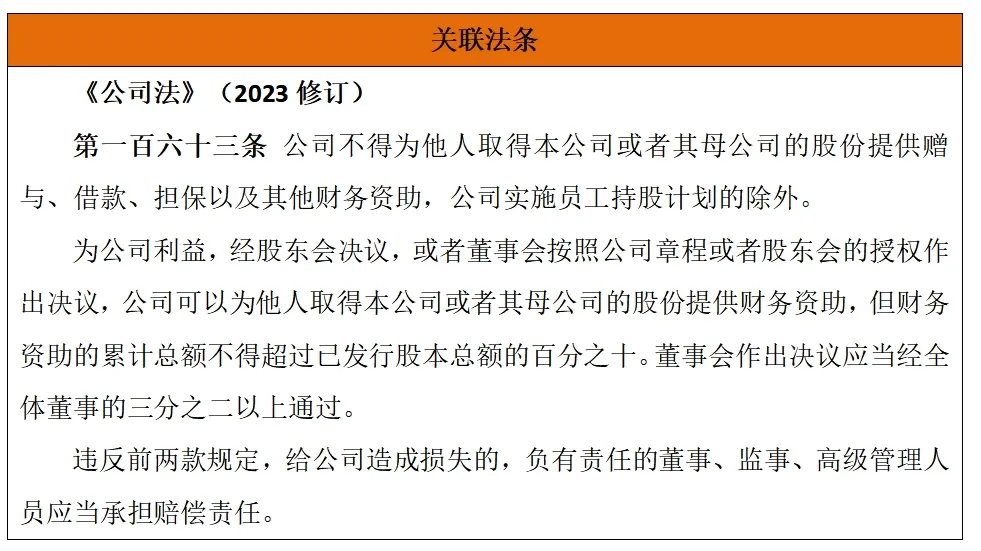

The new "Company Law" first established the principle prohibition of providing financial assistance to the company. According to the first paragraph of Article 163 of the new "Company Law", the company shall not provide for others to obtain the shares of the company or its parent company. Donations, loans, guarantees and other financial assistance should be understood as follows:

First of all,Because this clause is located in Chapter 6 of the new "Company Law" "Issuance and Transfer of Shares of a Limited Liability Company", there is no such provision in the "Establishment and Organizational Structure of a Limited Liability Company" and "Equity Transfer of a Limited Liability Company". In terms of legal structure, this principled prohibition only applies to "joint stock limited companies". As for whether it is applicable to "limited liability company", the current legal and judicial interpretation has not been clearly defined. However, the author believes that from the point of view of the legislative purpose of prohibiting financial support, if the behavior is contrary to the principle of corporate capital maintenance, the provision may also be applied by reference to the limited liability company.

Secondly,This principled prohibition provides for an incomplete enumeration of the "forms of financial assistance" that companies are prohibited from providing.

① A gift, which is a gratuitous grant for the company to acquire shares in the company or the parent company from others, will directly result in an undue reduction of the company's assets and is prohibited by legislation;

Borrowing, that is, the company to others to obtain the company's shares to lend funds, belongs to the company's assets into the company's debt, increase the company's debt, and if the borrower can not repay the loan in a timely manner, it will eventually evolve into the company through the acquisition of its own shares to realize the creditor's rights, disguised as equity repurchase behavior, resulting in improper reduction of the company's assets;

③Guarantee, that is, guarantee for others to obtain the company's shares, in the case of others can not repay the debt, the company assumes the responsibility of guarantee, which leads to the improper reduction of the company's assets, disguised to harm the legitimate interests of other shareholders and creditors of the company.

④ Other financial support behaviors, because the company's financial support behavior may be hidden and diverse, there are direct financial support, such as gifts, loans, guarantees, and indirect financial support, which cannot be included in the form of a one-to-one list. When determining whether it is a financial support behavior, the principle of "whether it will unduly reduce the company's assets" and "lead to a disguised distribution of the company's assets to future shareholders or original shareholders" should be reasonably determined.

Again,The "other person" in the principle prohibition has two directions, one refers to the new shareholder who intends to purchase the shares of the company or the parent company, and the other refers to the original shareholder who intends to increase the shares of the company or the parent company.

And finally,The "shares" of the Company or the parent company acquired by others under the principle prohibition include not only the shares of the company, but also the debt certificates of an equity nature, such as corporate bonds.

(II) Exceptions to Prohibiting Corporate Financial Assistance

1. Specific Exceptions-Financial assistance available for the company to implement an employee stock ownership plan.

The first paragraph of Article 163 of the new "Company Law" stipulates the specific exceptions that "the company may provide financial assistance for the implementation of employee stock ownership plans. Because the company's employee stock ownership plan is a special benefit plan that can help the company attract talent, retain core talent and restrain management talent, considering the issue of employee compensation, the purchase of company shares may have certain difficulties and limited purchasing power. Therefore, in this case, when the company is allowed to implement the employee stock ownership plan, the company can make financial support, which also reflects the flexibility of China's legislation on the company's financial support system.

2. General Exception-A company is allowed to provide financial assistance for others to acquire shares in the company or the parent company for its own benefit.

The second paragraph of Article 163 of the new "Company Law" stipulates a general exception to the prohibition of financial assistance by a company, that is, for the benefit of the company, the company is resolved by the shareholders meeting, or the board of directors makes a resolution in accordance with the company's articles of association or the authorization of the shareholders meeting. The company may provide financial assistance for others to obtain shares of the company or its parent company, but the cumulative total amount of financial assistance shall not exceed 10% of the total issued share capital. A resolution made by the board of directors shall be adopted by a 2/3 or more of all directors. This general exception can be understood in three elements:

① Substantive elements-for the benefit of the company. The intention of the new "Company Law" to add a system of corporate financial assistance is to prevent improper reduction of company property and the disguised distribution of company assets to future shareholders or original shareholders. Under the condition of "for the benefit of the company", allowing the company to provide financial assistance for others to obtain shares of the company or its parent company does not violate the original intention of the legislation.

② Procedural requirements-subject to a resolution of the shareholders' meeting, or the board of directors in accordance with the articles of association or the authorization of the shareholders' meeting. Because the company's financial assistance may lead to the improper reduction of the company's assets, which in turn affects the interests of the company's shareholders, the new "Company Law" requires the corresponding procedural requirements to be met when allowing financial assistance for the company's interests, that is, the company's financial assistance must be resolved by the shareholders' meeting or authorized by the board of directors.

③ Capital ratio requirements-the cumulative total amount of financial assistance shall not exceed 10% of the total issued share capital. This element places certain restrictions on the company's financial support, and limits the amount of financial support the company can make in order to prevent the company from improperly influencing the company's share price.

The general exception provision is more abstract, and it is helpful to understand the practical application scenarios of the provision through the following examples:

① Technological innovation cooperation: For example, a technology company wants to bring in an expert with key technologies to become a shareholder in order to accelerate the product development process. The expert's personal funds are not sufficient to purchase the company's shares directly, and the company, by resolution of the shareholders' meeting or authorization of the board of directors, provides the expert with a loan or other form of financial assistance to help him purchase a certain percentage of the company's shares. It is in the company's interest to directly promote technological innovation and competitiveness in this way.

② Optimization of corporate restructuring: For example, in the process of corporate restructuring, if the company believes that the absorption of the minority shareholders' rights and interests of a subsidiary or related enterprise will be conducive to resource integration and efficiency improvement, but these minority shareholders lack the ability to pay to purchase additional shares, the company can help them complete the share purchase through financial assistance.

③Diversification strategy promotion: For example, if a company intends to enter a new business field through diversification strategy, it may consider cooperating with professionals or teams in this field. One way is to make these external partners become shareholders of the company. If these partners find it difficult to invest directly due to financial constraints, the company provides them with the necessary financial support to acquire shares in the company and jointly promote new business development.

Legal Liability of (III) Directors, Supervisors and Senior Managers

Because directors, supervisors, and senior managers have a duty of trust to the company, in the general exceptions to the company's financial assistance system, it also stipulates that the board of directors may make a resolution on the company's financial assistance in accordance with the company's articles of association and the authorization of the shareholders meeting. However, if a director, supervisor or senior manager violates the first two paragraphs of Article 163 of the Company Law and causes losses to the company, he shall be liable for compensation.

In such liability claims, depending on the behavior and the subject of responsibility, the company is generally the plaintiff, and in accordance with the relevant provisions of the company, the directors, supervisors or shareholders on behalf of the company to the people's court to bring a lawsuit for liability for damage to the interests of the company or the company's related transactions. At the same time, according to Article 192 of the new Company Law, if the controlling shareholder or actual controller of a company instructs a director or senior manager to engage in an act that harms the interests of the company or shareholders, he shall bear joint and several liability with the director or senior manager.

The relationship between the financial support system of 3. listed companies and Article 163 of the new Company Law

In addition to the general provisions of Article 163 of the new Company Law, listed companies are subject to more specific and stringent requirements and regulatory guidelines aimed at protecting the interests of investors, enhancing transparency and preventing financial risks. The following are possible differences or additions between the financial assistance provisions for listed companies and Article 163 of the new Company Law:

1. Information disclosure requirements: Listed companies need to disclose information on external financial assistance in a timely, accurate and complete manner in accordance with the regulations of the China Securities Regulatory Commission and the stock exchange, including funding objects, amounts, deadlines, interest rates, decision-making procedures, risk assessment and response measures Wait to ensure that the market and investors can fully understand relevant information.

2. Review and approval procedures: In addition to the resolutions of the shareholders' meeting or the board of directors required by the Company Law, the articles of association or internal management system of listed companies may set up a more stringent approval process for financial assistance, for example, independent directors may be required to express their opinions, or a special resolution of the general meeting of shareholders may be required.

3. Restrictions and proportional restrictions: Some regulatory rules or exchange guidelines may impose a cap on the external financial assistance of listed companies, such as not exceeding a certain percentage of the company's net assets, or limiting the amount of assistance to a single object, in order to prevent the risk of over-concentration.

4. Risk management and follow-up monitoring: Listed companies need to establish a sound risk assessment and control mechanism, continuously track and manage financial funded projects, regularly evaluate the solvency of funded objects, and ensure the safety of funds.

5. Prohibitive provisions: Under certain circumstances, if the object of funding is a related party, in addition to complying with Article 163, it is also necessary to comply with the relevant provisions of related transactions to avoid the transfer of benefits and ensure the fairness of the transaction.

6. Special management system: Listed companies usually need to formulate a detailed financial assistance management system to clarify the conditions, procedures, quotas, risk control and other specific requirements of financial assistance, which is more detailed than the general provisions of the Company Law.

To sum up, when implementing financial assistance, listed companies should not only abide by the basic principles of Article 163 of the Company Law, but also follow more specific regulatory requirements and internal management systems to ensure the compliance and rationality of financial assistance activities.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province