Viewpoint. The impact and application of the Uniform Practice of Documentary Credits (UCP600) on international trade payments.

Published:

2024-03-22

UCP600 plays a vital role in promoting the smooth progress of international trade and safeguarding the rights and interests of all parties, and this paper aims to explore in depth the impact and application of UCP600 on international trade payments, as well as prospects and suggestions for future development.

As an important engine of global economic development, international trade is becoming more and more frequent in the context of globalization. However, due to the international trade involving transnational business, the differences in laws and regulations of different countries and cross-cultural communication and many other complex factors, payment methods and payment security has become a problem that can not be ignored in international trade. In order to regulate and ensure the security and smooth progress of international trade payments, the International Chamber of Commerce (ICC) has developed a series of trade practices, one of which is UCP600, which is widely used in international trade. UCP600 plays a vital role in promoting the smooth progress of international trade and safeguarding the rights and interests of all parties, and this paper aims to explore in depth the impact and application of UCP600 on international trade payments, as well as prospects and suggestions for future development.

Background of 1. UCP600

The background of UCP600 can be traced back to the early UCP500 and UCP400. These practices regulate the use of letters of credit to some extent, but also expose some problems and shortcomings. With the development and changes of international trade, UCP600 came into effect on July 1, 2007 after rigorous and meticulous revision, fully reflecting the latest developments in finance, trade, transportation, insurance, law and information technology, in order to better adapt to the needs and challenges of today's international trade.

Main contents of 2. UCP600

As an important norm of international trade payment, UCP600 stipulates the definition of letter of credit, the responsibilities and obligations of all parties, document review standards and other contents directly affect the security, reliability and efficiency of international trade payment.

1. The concept of a letter of credit

2. Basic principles of letters of credit

3. Responsibilities and Obligations of the Parties

4. Document review criteria

3. the Application of UCP600 in Actual International Trade

3.1 Letter of Credit Payment Process

UCP600 specifies the payment process for letters of credit, including the steps of opening a letter of credit, notifying the beneficiary, submitting documents by the beneficiary, reviewing documents by the issuing bank, and making payments. This process ensures the security and reliability of letter of credit transactions, which are carried out by all parties in accordance with the regulations and can reduce the risk of transactions.

The impact of 3.2 UCP600 on the interests of all parties in international trade.

3.3 Case Demo

This case shows UCP600's specifications and requirements for the payment process of letter of credit, including issuing, notifying, document submission and payment. Local banks strictly follow UCP600 document review standards to ensure the conformity of documents and the safety of payment. Through timely communication and negotiation, Company B successfully completed the revision of documents and finally obtained payment, avoiding unnecessary delays and disputes.

How 3.4 can reduce trading risks and disputes

4. UCP600 in e-commerce applications and challenges

In today's digital trade era, the application of UCP600 in e-commerce is of great significance. With the development of e-commerce, UCP600 needs to be constantly updated and improved to adapt to the new trade environment and technological development. Domestic international trading companies cooperate with overseas suppliers to use e-commerce platforms for trade, and the two sides reach a trade contract involving the purchase and sale of bulk commodities. In this process, both parties choose to use the letter of credit as the payment method and operate according to UCP600. The specific process is:

UCP600 faces various challenges in e-commerce, but some measures can be taken to solve them. The specific suggestions are as follows:

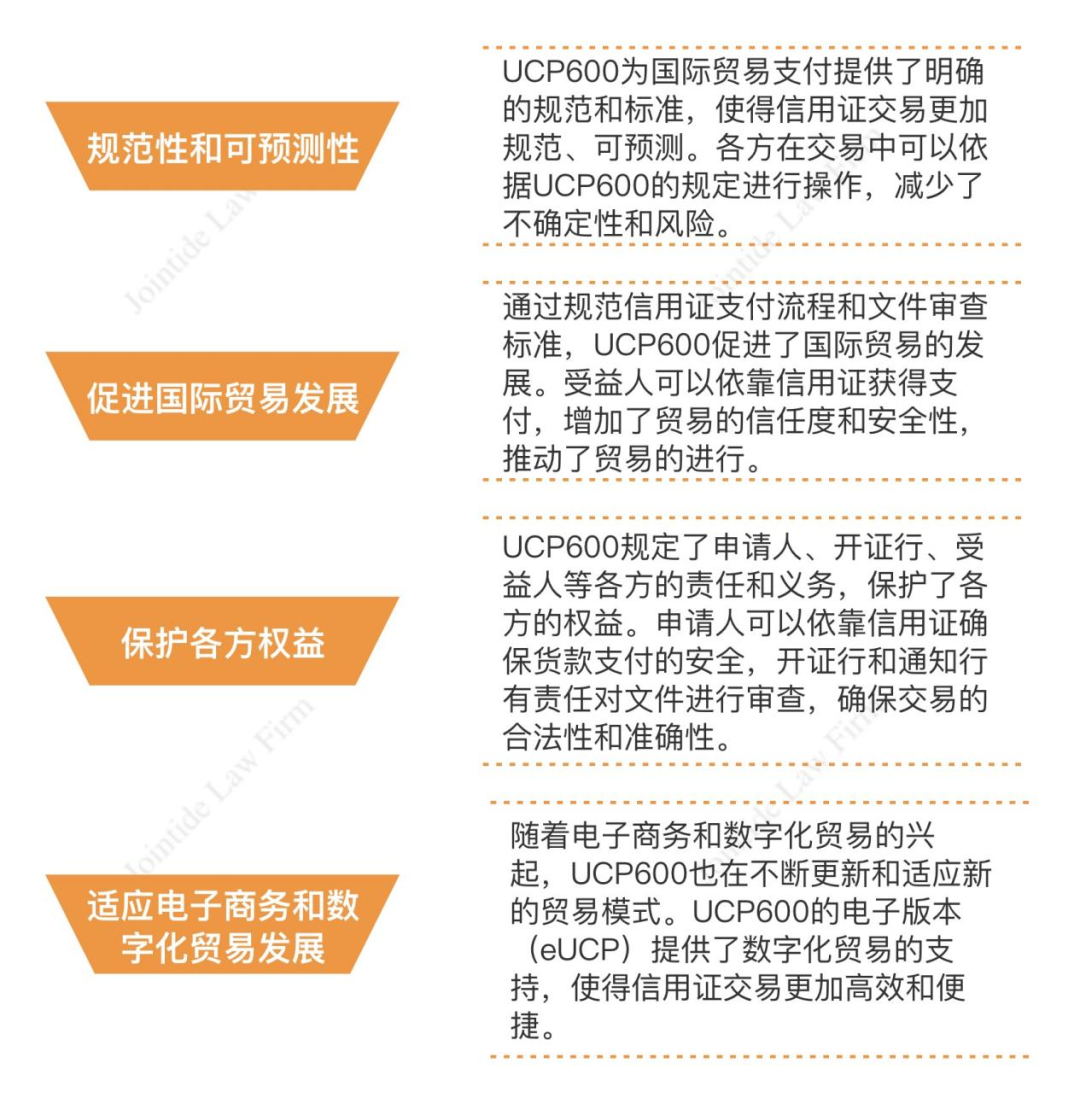

The advantages and disadvantages of 5. UCP600

As an important specification in the field of international trade payment, UCP600 has a series of advantages and disadvantages. Advantages of UCP600 include:

Disadvantages of the UCP600 include:

6. Summary and Prospect

As an important standard in the field of international trade payment, UCP600 has played an active role in practical application. By standardizing the payment process of letters of credit and document review standards, it promotes the development of international trade and enhances the predictability and security of transactions. However, UCP600 also faces some challenges, such as adaptability to emerging payment methods, impact on small businesses and emerging markets. UCP600 should pay more attention to the development of electronic and digital, optimize the review process, and provide a more convenient, efficient and secure payment method for e-commerce. At the same time, with the emergence of new payment methods, UCP600 should be constantly updated and adjusted to ensure compatibility and adaptability with new payment methods to adapt to the new trade environment and technological development. In addition, strengthening international cooperation and exchanges, jointly formulating rules and standards that are more in line with actual needs, and promoting the standardization and facilitation of international trade payments will be an important direction for the future development of UCP600.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province