Perspective | The Horizontal Denial of Personality System of Related Companies under the New Company Law—An Empirical Study of Personality Confusion and Proof Standards

Published:

2025-08-01

Against the backdrop of a declining economy, the abuse of corporate legal personality and limited shareholder liability by controlling shareholders or actual controllers, and the evasion of debts in the form of related companies, is increasing. How to protect the interests of creditors by denying the personality of related companies has become a problem. Although Articles 20 and 63 of the original Company Law did not involve the denial of the personality of related companies, cases in judicial practice protecting the interests of creditors by denying the personality of related companies are numerous. The most typical example is Guiding Case No. 15 issued by the Supreme People's Court, but this case did not solve the problem of lack of legal basis in judicial judgments. Article 23 of the new Company Law provides a clear legal basis for the denial of the personality of related companies. The horizontal denial of the personality of related companies can be basically divided into types such as "personality confusion", "improper benefit transfer under related relationships", and "improper asset transfer under actual control". This article conducts an empirical study on "personality confusion", the most common type among these types, and combines the first successful case of denial of the personality of a related company in a certain district of Jinan City that the author handled after the implementation of the new Company Law, to actively explore the evidentiary standards in judicial practice, in order to protect the legitimate rights and interests of creditors and provide valuable reference for the handling of similar cases in the future.

Abstract: Against the backdrop of a declining economy, the abuse of corporate legal personality and limited shareholder liability by controlling shareholders or actual controllers, and the evasion of debts in the form of related companies, is increasing. How to protect the interests of creditors by denying the personality of related companies has become a difficult problem. Although Articles 20 and 63 of the original Company Law did not involve the denial of the personality of related companies, cases in judicial practice that protect the interests of creditors by denying the personality of related companies are numerous. The most typical example is the No. 15 Guiding Case issued by the Supreme People's Court, No. 15 Guiding Case , but this case did not solve the problem of lack of legal basis in judicial judgments. Article 23 of the new Company Law has provided a clear legal basis for the denial of the personality of related companies. The horizontal denial of the personality of related companies can be basically divided into types such as "personality confusion", "improper benefit transfer under related relationships", and "improper asset transfer under actual control". This article conducts an empirical study on "personality confusion", the most common type among these types, and combines the author's successful case of denying the personality of a related company in a certain district of Jinan City after the implementation of the new Company Law, to actively explore the standards of evidence in judicial practice, in order to protect the legitimate rights and interests of creditors and provide valuable reference for the handling of similar cases in the future. Personality Confusion ”“关联关系下的不当利益输送”“实际控制下的不当资产转移”等类型,本文系针对各类型中出现最多的“人格混同”展开实证研究,并结合新《公司法》实施后笔者代理的济南市某区首例关联公司人格否认胜诉案件,积极探索司法实践中的举证证明标准,以期维护债权人合法权益,为后续同类案件的办理提供宝贵参考价值。

I. Historical Evolution of the Denial of the Personality of Related Companies

(I) Overseas Lessons on the Horizontal Denial of the Personality of Related Companies

In 1905, in the Milwaukee Refrigerator Transit case in the United States, Judge Sanborn, who presided over the case, believed that under normal circumstances, the independent personality of a company should be protected. However, if the independence of a company is used as a tool to harm public interests, undermine the legitimate rights and interests of creditors, and legalize illegal acts, the law should deem such companies as "groups of individuals" without capacity [1].

Due to the increasing concealment of the abuse of legal personality, the Single Business Entity Theory emerged, laying the theoretical foundation for the denial of the personality of related companies in the United States. This theory holds that if shareholders or actual controllers establish multiple related companies for improper purposes such as evading debts or fraud, and there is a high degree of confusion and interest binding between the related companies, the various related companies can be regarded as different departments of the same company. In this case, these companies should be considered as the same business entity, sharing debts and enjoying independent personality [2].

After more than 100 years of development, a relatively complete theoretical system for the denial of the personality of related companies has been formed in the United States. However, even so, under the background of the common law system, how to clarify the applicable conditions for the denial of the personality of related companies and properly apply them to specific cases remains a matter of disagreement.

(II) Establishment and Development of Horizontal Denial of the Personality of Related Companies in China

In 2013, the No. 15 Guiding Case of the Supreme People's Court established a precedent for the denial of the personality of related companies (also known as "horizontal denial of legal personality"), which was a judicial case to make up for legal loopholes. However, there are significant differences in the understanding and application of this case in judicial practice. In 2019, the "Minutes of the National Conference on Civil and Commercial Trial Work" (hereinafter referred to as the "Nineth Civil Conference Minutes") further refined it, until 2023, when the new Company Law was promulgated, officially confirming the system of denying the personality of related companies at the legal level.

1. Guiding Case No. 15 of the Supreme People's Court

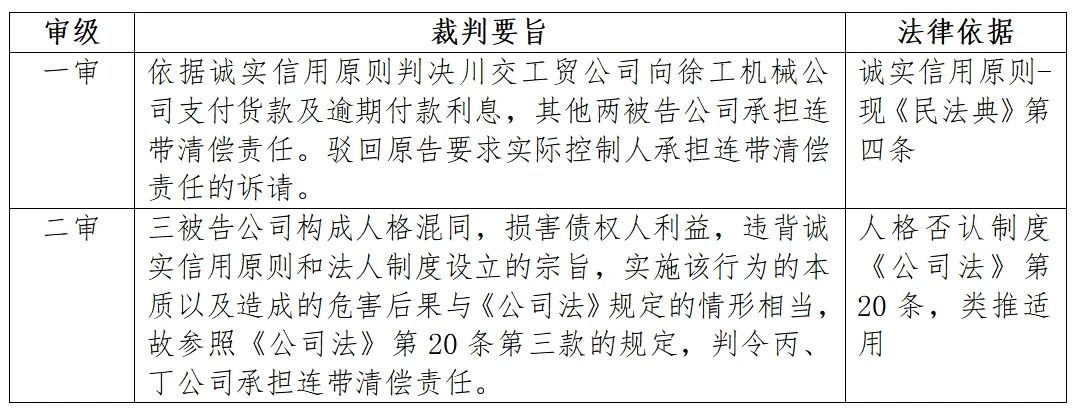

In 2013, the Supreme People's Court issued Guiding Case No. 15, and the horizontal denial of legal personality officially appeared in the Chinese judicial community. To briefly state the case, the parties to the case are replaced by companies A, B, C, and D. Company A sued companies B, C, and D and their shareholders. There is no control relationship between companies B and C and D in terms of equity. Company A claims that companies B, C, and D have personality confusion and requests that the three companies and their shareholders bear joint and several liability. The court found that companies B, C, and D have personnel confusion, with staff cross-appointments; there is also business confusion, with overlapping business scopes; there is also financial confusion, with the three companies sharing settlement accounts; the three companies have lost their independent personality and constitute personality confusion. At the same time, since Company B is unable to repay its debts and companies C and D can use their independent legal personality to evade debts, harming the interests of creditors, their personality should be denied.

It should be noted that although the first and second instance courts in this case essentially denied the legal personality of related companies horizontally, there are significant differences in the applicable basis of the judgment. The judgment method of the second instance court also marks the emergence of the system of horizontal denial of the legal personality of related companies.

Judgment Summary

2. "Minutes of the Ninth Civil Conference"

Article 11, paragraph 2 of the "Minutes of the Ninth Civil Conference" stipulates: "Where a controlling shareholder or actual controller controls multiple subsidiaries or related companies, and abuses its control to make the property boundaries of multiple subsidiaries or related companies unclear, finances confused, interests mutually transferred, and independent personality lost, becoming a tool for the controlling shareholder to evade debts, engage in illegal operations, or even commit crimes, the facts of the case can be comprehensively considered to deny the legal personality of the subsidiaries or related companies and order them to bear joint and several liability."

The above provision clarifies the horizontal denial of legal personality in a non-precedent form, further supporting Guiding Case No. 15. However, in judicial judgments, the "Minutes of the Ninth Civil Conference" can only be used for reasoning and cannot be used as a basis for judgment. In judicial practice, some courts will use the principles of fairness and good faith for discretionary judgment, some courts will use Article 20 of the original Company Law by analogy, and some courts will directly use the "Minutes of the Ninth Civil Conference" or Guiding Case No. 15 for reasoning. The basis for judgment is not uniform.

More importantly, since Article 20, paragraph 3 of the original Company Law does not involve the issue of denying the personality of related companies, even if Article 11, paragraph 2 of the "Minutes of the Ninth Civil Conference" supplements it, it is still difficult to handle the connection and application of the two.

3. Promulgation of the New Company Law

Article 23, paragraph 3 of the original Company Law: "If a company shareholder abuses the independent status of the company's legal person and the limited liability of the shareholder to evade debts and seriously harms the interests of the company's creditors, it shall bear joint and several liability for the company's debts"; Article 63: "If a shareholder of a sole proprietorship limited liability company cannot prove that the company's property is independent of the shareholder's own property, it shall bear joint and several liability for the company's debts." The former is a principled provision on the denial of personality, and the latter is a special provision for sole proprietorships.

The revised Company Law merges these two into one article (Article 23 of the revised Company Law) and clarifies the denial of the separate legal personality of related companies in paragraph 2 of that article: "If a company's shareholder abuses the company's independent legal personality and limited liability of shareholders to evade debts, seriously harming the interests of the company's creditors, they shall bear joint and several liability for the company's debts; if a shareholder uses two or more companies under their control to engage in the acts stipulated in the preceding paragraph, each company shall bear joint and several liability for the debts of any one company; for a company with only one shareholder, if the shareholder cannot prove that the company's property is independent of their own property, they shall bear joint and several liability for the company's debts."

In 2023, the revised Company Law was officially promulgated, thus providing a clear legal basis for the horizontal denial of legal personality.

II. Empirical Research on Horizontal Denial of Legal Personality of Related Companies - Personality Confusion

(I) Constitutive Elements and Proof Standards for Denial of Legal Personality of Related Companies

1. Subject Matter Elements and Proof Standards

(1) Scope of Creditor Determination and Proof Standards

Some believe that in the denial of the legal personality of related companies, creditors entitled to file a lawsuit should be limited to those whose claims are related to the personality confusion, i.e., only those where personality confusion or other abusive acts existed at the time the claim arose can apply this rule. If the personality confusion did not occur at the time the claim arose, the creditor is not entitled to claim personality confusion.

Some believe that as long as the related companies have personality confusion that seriously harms the interests of creditors, creditors can claim personality confusion, and the scope of application of personality confusion should not be restricted, which is not conducive to protecting the interests of creditors and does not conform to the legal principles of determining personality confusion. That is, as long as there is a situation where shareholders or controllers abuse the legal personality to evade debts, regardless of when the debt was formed, creditors can claim personality confusion.

The author agrees with the first view, because if the scope of creditors is not restrictively interpreted in judicial practice, it is easy to lead to the complete and permanent denial of the legal personality of related companies, and other creditors can directly claim rights with another effective judgment, leading to a large number of lawsuits. From the perspective of results, to determine whether the interests of creditors have been harmed by the implementation of the confusion behavior, it is also necessary to examine the correlation between the formation of the claim and the confusion behavior, rather than directly recognizing the litigation subject qualification of all creditors.

In cases of denial of the legal personality of related companies, the trial tendency in the Shandong region is still relatively conservative. Creditors should provide preliminary evidence of the correlation between the formation of the claim and the implementation of the personality confusion behavior, otherwise there is a risk of not being supported. If the related company transfers assets/personnel/business after the signing of the contract/during the litigation/during the performance of the contract from which the claim arose, then the creditor naturally has the subject qualification for litigation.

(2) Scope of Determination and Proof Standards for Related Companies

China's Company Law does not directly define the concept of "related companies," but there are relevant provisions in other legal regulations. For example, in the Enterprise Accounting Standard No. 36 - Disclosure of Related Parties " it is stipulated that related parties refer to enterprises in which one party has the ability to directly or indirectly control, jointly control, or exert significant influence over the other party, or if two or more parties are under the control of one party.

Article 265 of the revised Company Law stipulates: "Related relationships refer to the relationships between a company's controlling shareholder, actual controller, directors, supervisors, senior management personnel and the enterprises they directly or indirectly control, as well as other relationships that may lead to the transfer of company interests"; Article 182 stipulates: "Close relatives of directors, supervisors, and senior management personnel; enterprises directly or indirectly controlled by directors, supervisors, senior management personnel or their close relatives; and related persons with other related relationships with directors, supervisors, and senior management personnel…"

From the above legal provisions, it can be seen that although China's legislation does not directly define related companies, the definition of related relationships not only focuses on the direct control relationship of equity but also on the indirect control relationship; not only on the enterprises controlled by controlling shareholders, directors, supervisors, and senior management, but also on the enterprises controlled by the actual controller; not only on regulating related enterprises but also on regulating related personnel.

In cases of denial of the legal personality of related companies, related companies generally use shareholders or other controllers as intermediaries to implement personality confusion or benefit transfer behaviors. Therefore, creditors need to provide preliminary evidence to prove that there is a related relationship between the companies, that they are related companies, and that they are actually controlled by the same shareholder or other controller, which is a necessary condition for the denial of personality.

Example

In terms of specific proof standards, creditors can start from the equity control relationship, legal representatives and directors, supervisors, and senior management personnel, and family relationships of related companies to find connection points for determining related relationships. It should be noted that the overlap of equity and senior management within a specific period may not be supported, i.e., when the creditor's claim is formed or sued, the debtor has already prepared to evade debts, and the equity and senior management appointments and other public information cannot identify the related relationship. When handling specific cases, it is necessary to comprehensively collect evidence from the establishment, development, and current situation of the related companies to further prove the continuity of the related relationship. In judicial practice, the proof standard required for related relationships is relatively low. Creditors only need to prove in any of the above aspects to meet the standard that the companies have a related relationship and may be controlled by the same controller.

2. Result Elements and Proof Standards

(1) Creditor's Loss Reaches "Serious" Level

The independent legal personality of a company and the limited liability of shareholders are basic principles of company law, and the denial of personality is an exceptional rule, the application requirements must be very strict, so the result element of "seriously harming the interests of creditors" should be considered a necessary constitutive element. However, the judgment standard of "serious harm" in practice is not clear and has not yet reached a unified opinion.

Article 12, paragraph 2, of the "Several Opinions of the Second Civil Trial Division of the Shanghai Higher People's Court on Trying Cases of Denial of Corporate Legal Personality" stipulates: "In the following circumstances, the people's court should not apply the principle of denial of legal personality: Although the company has failed to repay its due debts, there is a possibility of repaying the debts, which does not constitute serious harm to the interests of creditors." Article 41 of the "Guiding Opinions on the Trial of Company Dispute Cases by the Second Civil Trial Division of the Guangxi Zhuang Autonomous Region Higher People's Court" stipulates: "The damage suffered by the creditor as the plaintiff must reach a "serious" level, that is, not only does the company lose the ability to repay the plaintiff's claims, but other legal bases also cannot protect the interests of the creditor; for example, although the controlling shareholder has relevant abusive behavior, if the company has sufficient assets, the creditor should not directly sue the shareholder for joint and several liability; for example, if there is evidence clearly showing that the controlling shareholder has taken 30 million yuan from the company without accounting, it should be directly sued for recovery. Only if the controlling shareholder and the company's property are completely mixed, and it is impossible to calculate the specific amount that the controlling shareholder has taken from the company without compensation, can the system of denial of corporate legal personality be applied."

The aforementioned courts have clearly emphasized the importance of fully considering the result element in personality denial cases, but in judicial practice, adjudicators often overlook this [3]. Some believe that requiring creditors to prove the "severity" would significantly increase their burden of proof, further hindering the initiation of personality denial. This not only objectively favors shareholders but also increases the difficulty for courts to apply relevant rules due to a lack of objective judgment standards, so it is suggested that courts should ignore this condition in trials [4].

This author believes that a direct proof model should be adopted for the result element of "serious damage to the creditor's interests." The judgment of "inability to repay due debts" can refer to Article 2 of the "Supreme Court's Provisions on Several Issues Concerning the Application of the Enterprise Bankruptcy Law of the People's Republic of China (I)", but it should be noted that "inability to repay" must be objective and continuous. In practice, creditors often prove this through evidence such as final judgments or the debtor's inability or cessation of payment.

(2) A certain causal relationship

While creditors prove significant damage to their interests, they also need to further prove a causal relationship between the "personality confusion" behavior and the consequence of "serious damage to the creditor's interests." If the inability to repay due debts is solely due to general market conditions or mismanagement, the personality denial of related companies cannot be applied.

3. Behavioral Elements and Proof Standards

(1) Financial Confusion

"A company's independent property is the material basis for its independent liability, and the company's independent personality is also reflected in the independence of its property [5]" . Both academic views and judicial practice regard property confusion as an essential element of personality confusion in related companies.

Specifically, the forms of property confusion between related companies often include sharing the same office space, sharing major production equipment with unclear ownership, gratuitous transfer/use of assets between each other, the same financial personnel, cross-payments, transfer of receivables, and lack of records in each other's financial books, ultimately making it impossible to effectively distinguish their respective properties. A comprehensive judgment and substantive determination should be made based on the evidence in the case, considering the difficulty of proof for the creditor. The creditor needs to provide initial evidence to raise reasonable doubt in the mind of the adjudicator. If the related companies cannot prove the independence of their property, property confusion should be deemed to have occurred.

(2) Personnel Confusion

Personnel confusion is one of the manifestations of personality confusion in related companies. Creditors can usually gather evidence from shareholders, legal representatives, directors, supervisors, senior executives, management personnel, financial personnel, and business personnel. "One team, multiple companies" is a typical example of personnel confusion and a key manifestation of cross-appointments in management.

However, personnel confusion is only one way to supplement personality confusion. The personality of a company cannot be denied solely because of personnel confusion between companies. The law does not prohibit related companies from assigning management personnel to each other. For example, a professional manager serving as the legal representative or director, supervisor, and senior executive of multiple companies is normal business practice. The entire case evidence must be considered to determine whether the confused personnel have engaged in acts that harm the creditor's interests. Simply because of personnel overlap, it cannot be considered that the personalities of related companies are unified, which can easily lead to confusion in the determination of personality relationships. [6]

(3) Business Confusion

Business confusion means that the businesses of related companies cannot be clearly distinguished. This is mainly manifested in the high homogeneity of company businesses, and the trading entities and actual entities in a large number of transactions do not match or cannot be identified [7]. This is mainly manifested in overlapping business scopes, inconsistencies or cross-fulfillment between the contracting entity and the actual performing entity, and mutual transfer of business between related companies. In judicial practice, some courts directly determine business confusion based on the same or overlapping business scopes of related companies. Some courts combine business confusion with external identification elements, such as similar names, registered addresses, emails, and telephone numbers, to determine business confusion [8].

In terms of specific proof standards, given the nature of related company personality denial cases as tort liability, the plaintiff should still bear the burden of proof. The plaintiff's proof can follow the following approach:

First, after presenting preliminary evidence, the plaintiff can apply to the people's court for investigation and evidence collection according to Article 2 of the "Civil Procedure Evidence Provisions": "If a party cannot collect evidence on its own due to objective reasons, it may apply to the people's court for investigation and collection." The focus should be on applying for the collection of bank statements, accounting books, accounting vouchers, or applying to a forensic accounting institution for a forensic audit of the defendant. According to Article 112 of the "Interpretation of the Civil Procedure Law" [9], the plaintiff can also apply to the court to order the defendant to submit financial documents and other written evidence. If the defendant refuses to submit them without justifiable reason, the defendant should bear the adverse consequences.

Second, when the plaintiff's evidence is relatively sufficient, proving that there is cross-overlap and confusion between related companies in terms of personnel, business, and finance, causing reasonable doubt about the confusion of company will and company property among normal trading entities, and because the creditor is at an information disadvantage, the creditor's evidence raises reasonable doubt about the shareholder or related company's abuse of the company's independent status and the shareholder's limited liability system, the sued shareholder or related company should bear the burden of proving that it has not abused its status and is an independent legal entity. If the related company cannot provide evidence, the creditor's claim should be supported.

III. Summary

The denial of the legal personality of related companies refers to the theory that, through shareholders or other controllers as intermediaries, related companies abuse the independent legal personality and the rules of limited shareholder liability, engage in personality confusion or improper benefit transfer, harming the legitimate rights and interests of creditors, and the controlled related companies should bear joint and several liability for the debts of other related enterprises. This theory is conducive to protecting the interests of creditors and further expands the scope of joint and several liability of related companies, which needs to be given full attention by creditors and shareholders of related companies.

As creditors, they should conduct necessary investigations during commercial transactions and pay close attention to whether the debtor has confusion with its related companies in terms of finance, personnel, and business. If there are such signs, they should sign supplementary agreements or retain relevant evidence of confusion as early as possible, so as to reach a standard sufficient to raise reasonable doubt in the judge's mind during litigation, facilitating evidence presentation.

As companies and shareholders with related relationships, they should pay attention to the legal consequences that personality confusion may cause related companies to bear joint and several liability, avoid engaging in suspected improper benefit transfer, and also pay close attention to whether there is unreasonable confusion in the equity, business, personnel, location, and publicity of related companies, avoiding the legal risks of personality denial.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province