Low-altitude Economy | Determination of Unmanned Aerial Vehicle Product Insurance Liability from a Legal Perspective

Published:

2025-04-07

Low-altitude economy refers to a comprehensive economic form that drives the integrated development of related fields through various low-altitude flight activities involving both manned and unmanned aerial vehicles. In 2024, "low-altitude economy" was written into the Government Work Report for the first time, and it was mentioned again in the Government Work Report at the conclusion of the Two Sessions in 2025, demonstrating the huge development potential of this trillion-level "blue ocean". The low-altitude economy is accelerating its "take-off." As an important part of supporting the development of the low-altitude economy, low-altitude economic insurance, especially unmanned aerial vehicle (UAV) product insurance, has attracted much attention; the industry calls it "air car insurance." However, compared with car insurance, the risk situation of UAV product insurance is more complex. Coupled with the fact that UAV applications are still emerging, and relevant laws and regulations need further improvement, this article will analyze the issue of liability determination for UAV product insurance from a legal perspective.

Low-altitude economy refers to a comprehensive economic model driven by various low-altitude flight activities involving both manned and unmanned aerial vehicles, radiating and promoting the integrated development of related fields. In 2024, "low-altitude economy" was written into the Government Work Report for the first time. It was mentioned again in the Government Work Report at the Two Sessions at the end of 2025, indicating that this trillion-level "blue ocean" of low-altitude economy holds tremendous development potential.

The low-altitude economy is accelerating its "takeoff." As an important part of supporting the development of the low-altitude economy, low-altitude economic insurance, especially drone insurance, has attracted much attention; the industry calls it "air car insurance." However, compared with car insurance, the risk situation of drone insurance is more complex. In addition, drone applications are still emerging, and related laws and regulations need further improvement. This article will analyze the determination of drone insurance liability from a legal perspective.

I. Types of Drone Insurance

The "Interim Regulations on the Administration of Unmanned Aircraft Flights," jointly issued by the State Council and the Central Military Commission, has been officially implemented since 2024. For the first time, it clarifies the rules of drone insurance in the form of administrative regulations: operational drones must be compulsorily insured for liability insurance; non-operational drones, except for micro and light types, also need liability insurance, marking a step towards a standardized risk prevention system for China's low-altitude economy.

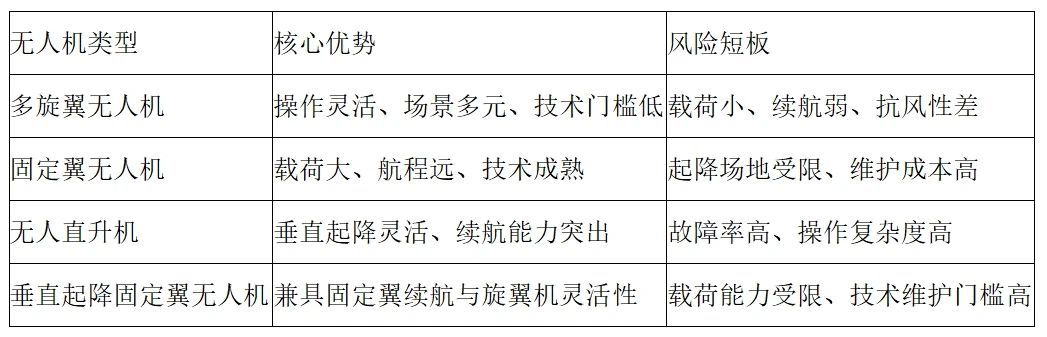

Currently, insurable drones are mainly divided into four categories, and their technical characteristics and risk characteristics directly affect insurance adaptability:

For the above types of drones, the current insurance products are mainly the following two categories:

(1) Hull Insurance: Hull insurance mainly covers accidental loss or damage to the drone, and the insurance company can compensate for related losses; related losses include disassembly, transportation, and repair costs after the drone is damaged. It also covers necessary and reasonable emergency rescue expenses incurred to ensure the immediate safety of the drone after destruction or emergency landing;

(2) Third-party liability insurance ( Third-party liability insurance ): Third-party liability insurance mainly covers the death and property losses of third parties caused by the fall of a drone or items on the drone. The insurance company will compensate for personal injury or property damage to third parties caused by accidents during flight.

II. Core Controversial Points in the Determination of Drone Insurance Liability

1. Determination of the Responsible Party

To determine the liability of drone insurance, the responsible party in drone damage must first be identified. Common responsible parties in drone damage mainly include the drone user, owner, drone manufacturer, or a third party. Under normal circumstances, for individual users, the user is often the owner, and the responsible party is relatively clear in the event of drone damage; in the case of enterprise users, the ownership of the drone belongs to the company, and the actual user is the company's employee. If the employee uses the drone for job-related duties and causes harm to others, according to Article 1191 of the Civil Code, the employer shall bear the liability for infringement; if the employee is at fault, the employer has the right to recover the compensation after compensation; if the drone crash or damage to others is due to defects in the drone product itself, according to Article 1202 of the Civil Code, the manufacturer shall bear the liability for infringement if the product defect causes harm to others; if a third party's fault causes the damage, compensation should be sought from the third party.

Clarifying the responsible party is of great significance to determining the attribution of compensation liability and clarifying the rights and obligations relationship. However, due to the emerging nature of drones, there are still some problems in the determination of product liability for drones. For example, in the determination of product defect liability, factors such as improper user operation and the probative effect of product qualification documents will affect the determination of the responsible party.

2. Determination of Whether the Cause of the Accident Is Within the Scope of Coverage

In drone insurance contracts, the "coverage" clause usually stipulates the situations in which the insurance company will pay compensation in a general or listed manner (e.g., "accidental accidents"). However, in practice, whether the cause of the accident falls within the "coverage" often leads to disputes due to ambiguous wording.

For example, in the insurance dispute case between Xi'an Moxin Aviation Technology Co., Ltd. and the Xi'an Branch of the People's Insurance Company of China ( (2024) Shaanxi 0103 Min Chu 1804), the plaintiff claimed that the accident was caused by a "sudden unexpected situation with the drone causing the aircraft to crash." After the accident, the plaintiff applied to the defendant for insurance compensation, but the defendant refused to pay compensation on the grounds of mechanical failure.

For example, if the insurance clause states that "losses caused by design or manufacturing defects of the drone are not covered," is the cause of the accident a "product quality problem" or "improper operation"? Does the insured need to claim compensation from the manufacturer first?

In the product liability dispute case between Hunan Guanghua Defense Technology Group Co., Ltd., Jiangsu Foller Aviation Technology Co., Ltd., and Suzhou Branch of China Pacific Property Insurance Co., Ltd. ((2020) Xiang 0181 Min Chu 1007), the defendant manufacturer claimed that the crash of the drone was caused by its own fault, not a product quality problem. Because the defendant failed to provide evidence to prove that there were no defects in the unmanned helicopter involved in the case, the court held that it should bear the adverse consequences of failing to fulfill its burden of proof; the defendant insurance company argued that this case was a product liability dispute and should not be a defendant in this case. The court held that this case was a product liability dispute and the defendant insurance company was not related to the legal relationship of product quality infringement liability.

Therefore, due to ambiguous wording in the clauses, the trial process often requires more effort in determining the cause of the accident, and there is a problem of inconsistent allocation of the burden of proof.

3. Determination of the Causal Relationship Between Behavior and Accident

With the rapid development of drone technology, the application scenarios of drone technology are also very wide, such as logistics transportation, manned transportation, tourism, emergency rescue, agricultural operations, and other economic activities. Therefore, in different industries, the specific circumstances of behaviors and accidents related to drone damage are different. In determining their causal relationship, it is necessary to analyze the specific circumstances.

For example, in the case of Zhang Mouguo v. Zhong An Property Insurance Co., Ltd. (case (2024) Yu 0825 Min Chu 2676), the plaintiff sprayed pesticides on a third party's crops while using a drone to spray pesticides on fruit trees, causing the third party's fruit trees to curl and yellow, resulting in certain economic losses to different fruit trees. The plaintiff claimed that the insurance payment should be paid in accordance with the provisions of third-party property losses in the insurance liability, while the defendant argued that the reason for the curling and yellowing of the fruit trees was the chemical effect of the sprayed pesticide, rather than the insured drone or items falling from the insured drone. The court found that due to the different pests and diseases suffered by different crops in different seasons, and the different proportions of pesticides, the damage to the fruit trees planted by the third party was caused by the chemical composition of the pesticides used for wheat pests and diseases being unsuitable for fruit trees, and therefore could not be identified as being caused by the drone or items falling from the insured drone.

Therefore, to determine whether there is a causal relationship between the drone and the damage, the cause of the damage needs to be specifically analyzed. Only if the damage is directly caused by the drone should the insurance company bear the insurance liability.

4. Determination of the scope of loss

In drone insurance disputes, the definition of "scope of loss" directly determines whether and how much the insurance company will pay. According to law and insurance practice, losses are generally divided into direct losses and indirect losses. Insurance contracts usually only cover direct losses unless indirect losses are explicitly agreed upon. Indirect losses often have unpredictability and ambiguity in calculation, and insurance companies usually exclude payment through exclusion clauses. For example, in the scenario of compensation for mental distress caused by a drone injuring someone, the court ruled that if the liability insurance clause explicitly excludes compensation for mental distress, the insurance company does not need to pay; if the clause does not explicitly exclude it, partial compensation may be supported. In Guan Changsheng v. Zhong An Online Property Insurance Co., Ltd., Donggang City Yixin Agricultural Machinery Professional Cooperative, etc., motor vehicle traffic accident liability dispute ((2024) Liao 0681 Min Chu 130), the defendant insurance company argued that the hospitalization meal subsidy, nursing fee, transportation fee, mental distress compensation, and identification and examination fee were not within the scope of insurance, the court did not support its defense.

III. Optimization Suggestions for Drone Insurance Liability Determination

From the perspective of legislation and regulation: Due to the richer practical application scenarios of low-altitude economy, and eVTOL and drones, etc., the technology iteration speed is faster, so the risk situation is more complex. At present, China does not have exclusive legal regulations on intellectual property rights, tort liability, privacy protection, data security, etc., related to the low-altitude economy. Therefore, legal issues or disputes in related fields mainly refer to general laws. Therefore, the state should accelerate the promotion of legislation on drone insurance liability, and regulatory departments should promptly promote the standardization of insurance clauses to reduce the "space for haggling".

From the perspective of the insurance industry: The insurance industry should increase its research efforts, continuously improve products and services, support the development of the low-altitude economy, develop comprehensive risk protection solutions for low-altitude economic operation management platforms, realize the standardization and online data element docking of insurance and air traffic management platforms, promote data interoperability between insurance institutions and low-altitude traffic management platforms, obtain airspace approval and electronic fence information in real time, and automatically verify the compliance of insured objects.

From the perspective of technological development: Complete technical standards should be formulated, using technical standards as a lever to implement risk responsibility allocation, using technical standards as an important reference for responsibility determination, clarifying the identification methods and responsibility allocation ratio for situations such as flight control system defects, human error, and external interference; promoting blockchain technology application to flight data preservation, ensuring the legal effect of electronic evidence; establishing a drone accident technical appraisal center to provide authoritative and neutral third-party liability assessment services.

From the dimension of judicial practice: Improve the mechanism for ascertaining technical facts. We can explore a mechanism in which judicial personnel with a background in aerospace engineering participate in the trial to assist in sorting out technical facts and solving the problem of judges' "technical blind spots" in the face of drones; the Supreme People's Court should publish typical cases of drone insurance disputes, clarifying the proximate cause principle application, "determination of indirect losses," and other judicial rules to reduce inconsistent judgments in similar cases; at the same time, we can promote the establishment of a negative list for judicial review of insurance clauses, directly determining the invalidity of clauses such as "expanded exclusion clauses" and "ambiguous coverage scope," forcing industry regulation.

With the continuous growth of the scale and volume of drones and the continuous enrichment of drones adapted to various application scenarios, the demand for insurance will also increase. If the low-altitude economy wants to fly "steadily" and "well," it urgently needs to establish a governance system of "insurance backing up risks, laws defining boundaries, and technology solidifying evidence," further strengthen top-level design and overall coordination, improve the insurance system related to drone products, strengthen legal construction in related fields, and improve the mechanism for determining the insurance liability of drone products, solving pain points that have emerged in judicial practice. Only through institutional innovation can we break the deadlock in liability determination, so that we can safeguard the safe flight of the low-altitude economy while injecting the momentum of rule-of-law development into the trillion-dollar market.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province